[Industry news] Sputtering pangasius export concern

30 March 2017

[Translated from Thoibaokinhdoanh.vn, find the original article here. We are not in anyway responsible for the content of this post]

The pangasius fillet market is showing signs of clumping in the EU, while exports to China, the market which bears inherent risks, are on the rise. The variety and complexity of standards from international importers form the challenges for the pangasius industry nowadays.

According to Vietnam Pangasius Association (VN Pangasius), catfish exports to EU market from the beginning of the year to the mid February 2017 reached USD 25.2 million only, down 17.6% over the same period. In 2016 and accounted for 15.3% of the sector’s exports.

By contrast, catfish exports to China have soared to over USD 27.4 million, up 53% year-on-year and accounted for 16.7 percent of the sector’s exports.

Contraction in the EU, rising demand in China

Recent statistics showed with the increasing volume of Vietnam’s seafood imports, China is emerging as a strong market, second only to the US (accounting for about 22%) and surpassing EU.

In terms of pricing, the Vietnam Association of Seafood Exporters and Producers (VASEP) recently said that the price of pangasius raw material increased in the first 3 months due to the short of supply compared to previous periods. In addition, many companies boosting the raw materials purchase for exporting orders in the first months of 2017 has pushed up the fish price.

Sharing with pangasius exporters at the conference “The impact of the world economy on the fisheries sector in Vietnam” held in Can Tho on 28/03, Mr. Vo Hung Dung, Vice Chairman cum General Secretary of VN Pangasius, said the pangasius price in the Mekong Delta is now reaching 27,000 VND/ kg. This can be said to be peak in recent years. However, it is difficult to forecast the pangasius price in the coming time.

“Someone asked me if I could predict if the price would drop further. I said I could not predict if fish prices would decline like it was in 2014 or not because noone can predict the future. Some people ask me how to buy or sell, I said when you see the acceptable price you should sell, do not wait, “- Dung shared.

The leader of VN Pangasius also noted the situation of export contraction in the EU market. Before the decline, export of pangasius to the EU market will be very difficult in the upcoming time when facing myriad competition. The Vietnam-EU free trade agreement (EVFTA) will save this or not remains open.

In view of Mr. Yohan Perrault, Eurocham’s Technical and Marketing Director for Asia, over the past few years, many export shipments of agro-forestry and fishery products in Vietnam have been returned by the EU market. This has hugely impacted the export of pangasius to the EU.

Looking back at the beginning of the year, catfish exports are forecasted to increase slightly by 4% (at over USD1.7 billion) in 2017. In which, the US market is the destination for 2-3 large enterprises, other enterprises It will focus more on the China, EU and ASEAN markets and push to Russia.

The variety and complexity of standards from international importers is a challenge for the pangasius industry nowadays

Difficult to meet standards

With regard to the China market, according to the assessment, in the past five years, the growth of pangasius exports to this market increased from 24.2 to 88.7% per annual. Of which, the total value of catfish exports to the market in 2016 reached nearly USD305 million, nearly doubling that of 2015 and increasing by 4.17 times compared to five years ago (2012).

Concerning the fears associated with over-dependence on the China market, some companies expressed that this is not worrisome. Because the demand for seafood in China is not similar to other commodities.

However, in the matter of payment, it is worrying that many Chinese enterprises propose to deposit only about 30% of the total pangasius shipment, plus the average shipping price of a batch of tra fish to the border of approximately VND 45 – 47 million. If the container makes it to the border and the Chinese purchaser receives the goods, the seller’s export transaction succeeds, otherwise the loss incurs.

In addition, the payment of tra fish orders to China is quite diversified, but many companies only pay in VND same as the domestic transactions. This has caused the exporters many difficulties when converting to other currencies.

Regarding the problem of pangasius processing, according to Dr. Nguyen Thanh Tung – Institute of Fisheries Economics and Planning – currently there are approximately 291 pangasius exporters, of which 2/3 are considered small establishments with less than 1,000 tonnes exported. Of the major exporters, there are 36 companies exporting over 5,000 tons.

However, these large exporters have a market share of about 75% of total catfish exports. At present, most of pangasius products are exported in the form of frozen fillet with few value-added products.

Dr. Nguyen Thanh Tung said that the diversity and complexity of standards from international importers is a challenge for the catfish industry, especially exporters.

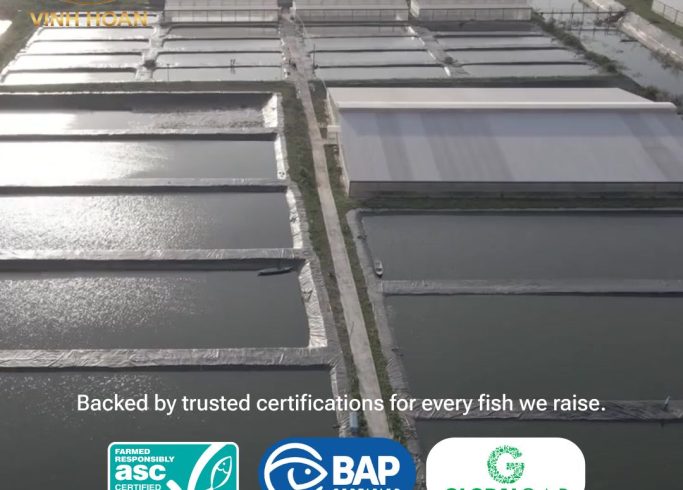

The most common current standards are: ACC (Aquaculture Certification Council) for the US retail market, Global GAP and the ASC for the EU retail market.

In addition, there is an increase in biosafety standards such as Naturland and Kraft. Although the current trend is that export processors have their own farms and are constantly investing to meet international standards, still it is difficult to meet all these standards.